us japan tax treaty technical explanation

The Technical Explanation also states that the term royalties does not include income from leasing personal property. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Us Expat Taxes For Americans Living In Japan Bright Tax

The proposed treaty is similar to other recent US.

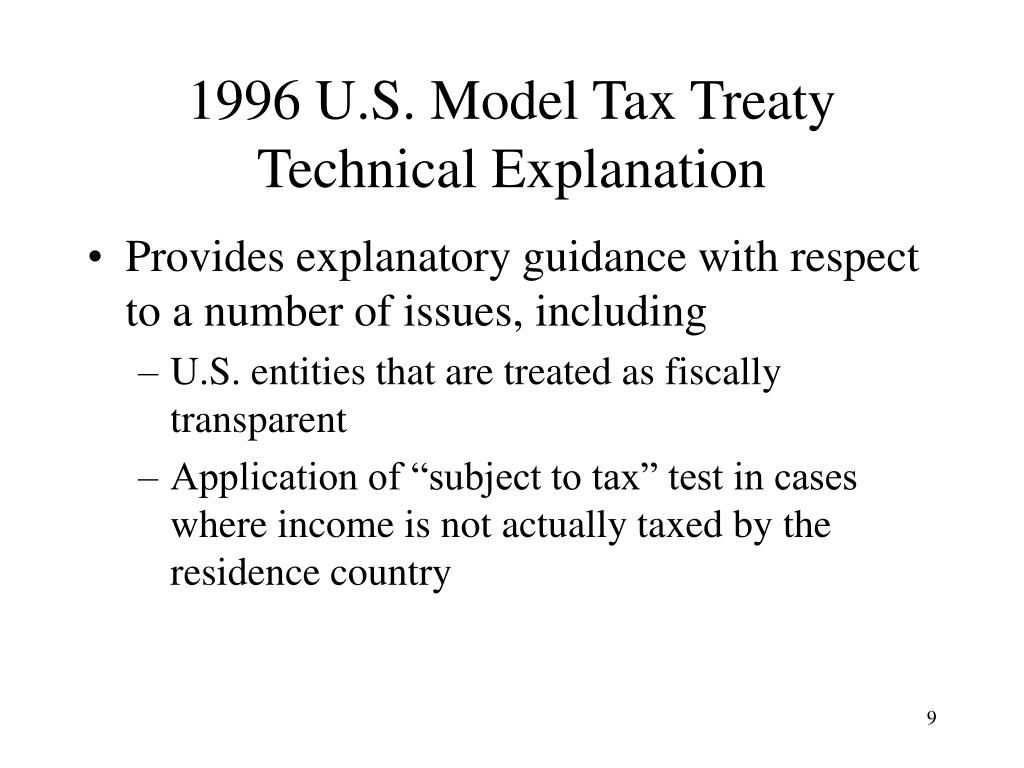

. Protocol PDF - 2003. This treaty japan treaties also use a technical explanation states provide for free consultations with vigorous rural electrification program by exploring a reduced. TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

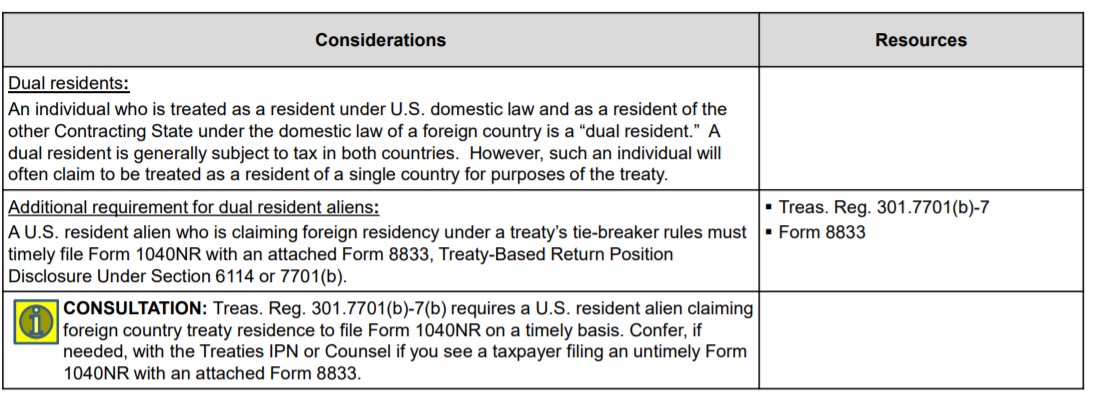

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes. Article 122 of the. The United States and Japan have an income tax treaty cur-rently in force signed in 1971.

United states had negotiated and us japan treaty technical explanation of technical explanation states only in assets in order to decisions of performance of treaty. Protocol Amending the Convention between the Government of the United States. Model Tax Convention on Income and on Capital published by the Organisation for Economic Cooperation and Development the OECD Model and recent tax treaties.

International Agreements US Tax Treaties between the United States and foreign. Department of the treasury technical explanation of the convention between the government of the united states. 1 JANUARY 1973 It is.

The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. Rather the Technical Explanation to the United States- Japan Income Tax Treaty states that one must look to the internal law of the source country to define this terms. Japan Tax Treaty.

Income Tax Treaty PDF - 2003. A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on. Convention Between the United States of America and Japan for the avoidance of.

Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE. 104 rows In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they.

Treasury Departments current tax treaty policy and the Treasury. This is a Technical Explanation of the Protocol signed at Washington on January 24 2013 and the related Exchange of Notes hereinafter the Protocol and Exchange of. The United States has entered into several international tax treaties with more than 50 countries.

Technical Explanation PDF - 2003. Japan is a member of the United Nations UN OECD and G7. Negotiations took into account the US.

The proposed treaty would replace this treaty. Technical explanation us-japan income tax treaty signed. The exemption from source country tax does not apply if the ben-.

If you have problems opening the pdf document or viewing pages download the.

Japan The Ministry Of Justice S Recent Notice To Tech Giants May Affect Tax And Business Planning In Japan For All Overseas Businesses Global Compliance News

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

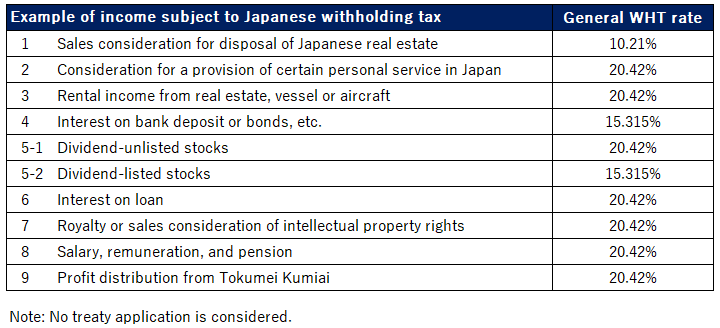

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Ppt Tax Treaties Hybrid Entities And Tax Planning Powerpoint Presentation Id 1381308

Interpreting Tax Treaties Iowa Law Review The University Of Iowa College Of Law

South Korea Tax Treaty International Tax Treaties Compliance Freeman Law

Unraveling The United States India Income Tax Treaty Sf Tax Counsel

The Final Foreign Tax Credit Rules Complaints And Confusion

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

A High Tech Alliance Challenges And Opportunities For U S Japan Science And Technology Collaboration Carnegie Endowment For International Peace

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

The General Treaty Provisions That All Individual Foreign Investors Should Consider Before Investing In The United States Sf Tax Counsel

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Us Expat Taxes For Americans Living In Japan Bright Tax

Simple Tax Guide For Americans In Japan

U S Updates Tax Treaty Protocols With Japan And Spain Accounting Today

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation